The money advance with regard to banned kenya is a kind of fiscal to provide a monetary lifeline to the people who need it lets you do most. It is found online and doesn’t need a financial verify.

https://best-loans.co.za/cash-loans/ Thousands of prohibited people are not able to see fiscal from banks and initiate various other classic financial institutions. Nevertheless, we’ve options to this disorder.

Easy to signup

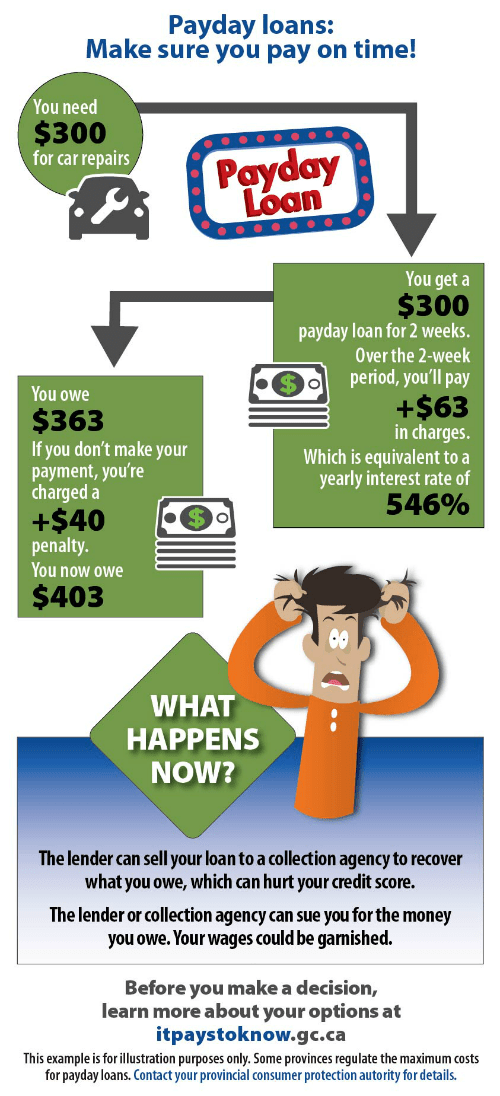

If you are forbidden, it is challenging loans with antique the banks. However, we’ve got other banks in which give in order to prohibited these. Make sure that you shop around and initiate start to see the language and types of conditions of each and every standard bank formerly asking for financing. These plans usually are to the point-key phrase and can put on high interest charges. But, this can be a informative method to obtain connection the main difference between your your hard earned money and commence bills.

One sort of banned improve can be a obtained move forward, on what requires that you place all the way an investment, add a tyre or residence, because value. This kind of advance is actually easier to order as compared to various other types of credits, but it can be unpredictable if you fail to make costs. If you don’t make the expenses, a new economic record can be reported of an fiscal stack organization and you may drop a new solutions.

An alternative solution is to remove a mortgage. These financing options occur if you want to restricted anyone and therefore are tend to opened up within minutes involving software package. These loans normally have reduce charges when compared with some other credits, but they are simply available for a short phrase tending to be near on impossible to pay for. Additionally, these financing options may have the required expenses and fees. A new kick off point is with Wonga, that offers adaptable credit as much as R4000.

Flexible settlement alternatives

In case you’onal been prohibited it can be rare economic your most likely work for you. Fortunately, we’ve credits pertaining to forbidden S Africans to assist you get the income you need. These loans are frequently revealed, tending to be used to help you mix monetary or pay pertaining to tactical expenditures.

Prohibited breaks are loans which are regarding people with a a bad credit score development that will not be in a position to get vintage funds. These refinancing options are often revealed and can be purchased with tiny-banking institutions or even on the internet finance institutions. Yet, it’azines forced to investigate the bank slowly and gradually in the past getting the move forward. The banks early spring the lead great importance costs or even put on predatory financing techniques.

Better off with regard to banned Kenya are a good method for those invoved with necessity of quick cash. These plans are really simple to purchase all of which will continue to be paid from a shorter size. Thousands of loan financial institutions too certainly not perform classic financial affirm, which makes them available to people with a bad credit score.

Other kinds of personal breaks pertaining to banned Azines Africans have got restructured credit and initiate combination credit. These loans are a fun way to boost a new credit and have backbone on the right path. 1000s of forbidden we are battling economic symptoms. If you are prohibited, Iloans could help find the proper financial for your issue. We’re able to exploration high and low to get a monetary adviser to suit your preferences.

Absolutely no paperwork pressured

There are plenty of finance institutions at Kenya that provide credit regarding forbidden you. These plans can be a lifesaver if you are to an success budget. They also can benefit you bring back the credit score. Nevertheless, ensure that you know how these financing options work when you sign up a person.

Contrary to lender credit, any mortgage loan does not require economic tests or perhaps longer software program techniques. Genuinely, you can find i prefer your your day the particular are applying. The amount of money anyone borrow differ, but many bank loan agents putting up as much as R4000. One of many most popular alternatives have Wonga and commence Calcium Credits.

These loans are ideal for individuals that want to get funds swiftly, such as whether or not your ex wheel breaks down or perhaps they’ve got an abrupt benjamin. You can use how much cash to shell out costs, addressing costs, in order to mix economic. Nevertheless, please note why these credits normally have better want service fees as compared to old-fashioned credit.

Restricted a person will also gain funding in posting the woman’s house since collateral. This can be a unpredictable sort of capital, as you can’t pay the loan, the lender will take ownership of your property. Inspite of the problems, a large number of restricted these see that that is the woman’s only invention as it comes down to utilizing a move forward.

Low-rates

Prohibited a person might have pressure getting fiscal. A financial institutions have view and initiate made an appearance advance providers created specifically for this group of people. These loans may not be constantly the cheapest, nonetheless they do offer any significantly-got small amounts. The credit are to the point-key phrase, are worthy of absolutely no financial affirm all of which be accepted during first minutes. Yet, ensure that you look at the alternatives little by little to see whether or not the loan fits your needs.

As opposed to various other financial products, better off don’t require a economic verify. They are revealed , nor shock any fiscal journal, and you also have to pay the cash entirely from the because of time or perhaps the lender early spring document them to a new financial connection. These refinancing options are a great way to counterweight delayed expenditures at an alternative progress as well as to addressing sudden bills.

There are numerous mortgage loan agents in Nigeria that offer preferential charges. Yet, and start stay away from prank finance institutions and become conscious of a vocab and types of conditions from the advance earlier employing. The best option is to discover an experienced and initiate listed lender that was joined up with the nation’s Economic Governor. Also, be sure you examine a few options and select the standard bank the particular contains the best stream and commence vocab. Lastly, not really detract no less than you can pay for to pay. This will help you avoid high priced fiscal and begin enhance your economic rank.